Business Growth Definition by Authors

Business Growth is a stage where the business reaches the point for expansion and seeks additional options to generate more profit. Business growth is a function of the business lifecycle, industry growth trends, and the owners desire for equity value creation.

Business growth capital is critical for all scale-up minded businesses. Choosing the right business growth capital for your business takes expertise and market knowledge- as no two companies are the same. Choose correctly, and your growth takes off. Choose unwisely and it could be a disaster. Rather than fit your capital need to a pre-existing structure, smart companies design their own structure to mitigate risk. Business growth is a function of resource availability and often requires up front investment. Whether an acquisition or business investment, it pays to be conservative in projecting returns over time. Choosing the right business growth capital comes down to the following variables:

- The size of the capital raise.

- The cost of capital

- The flexibility of capital.

- The term structure of capital.

These four variables must be optimized to arrive at the best business growth capital solution. Most companies use an advisor to evaluate and source capital, due to the criticality of the job. Each of these variables are solved with market intelligence and deal making expertise. The end result is a business growth capital solution that satisfies your unique need, and allows your scale-up vision to take flight.

At Attract Capital, we believe that every company should benefit from our proprietary process which delivers the best business growth capital solution for your specific need. We are finance experts that lay out options and quickly turn them into finance realities for you. It may be an asset based loan, a cash flow based loan, a mezzanine loan or a unitranche loan. Whatever the loan structure, it will fit your business growth need perfectly. Our business growth capital sourcing process has resulted in many successful capital raises and growth flights for clients. It works through the following actions:

- Shaping the loan structure with the best custom features.

- Articulation of the Company's strengths and growth story.

- Driving the lender engagement process

Through this, we access capital from multiple lender channels, simultaneously. We know the key things the lenders are looking for and are able to shape your deal to qualify. The end result is a larger amount of capital at a lower price, in one integrated growth capital solution. When deals are properly shaped and articulated, you win. Lenders gain comfort and provide larger loans. This reduces or eliminates your need for equity, allowing you to continue to own 100% of your shares.

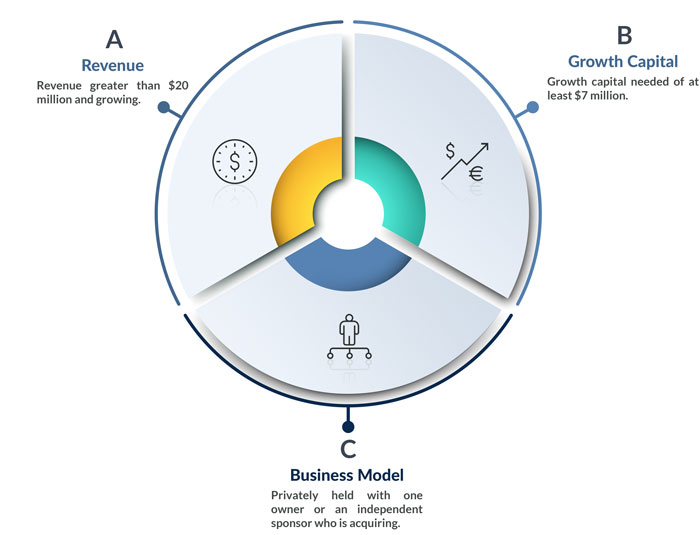

We work with the following type of middle market companies:

- Revenue greater than $20 million and growing.

- Growth capital needed of at least $7 million.

- Privately held with one owner or an independent sponsor who is acquiring.

Successful use cases have been:

- Growth capital to fund business scale-up

- Growth capital to fund new product development and launch

- Growth capital to fund regional expansion

- Growth capital to fund up front expenses and working capital build up

- Acquisition roll ups

- Acquisitions by Independent sponsors

- Company to Company acquisitions

What We Offer

- Corporate Finance Expertise

- Vast Practical Experience

- Legendary Customer Service

Learn More

Latest M&A Industry Updates!

- Current trends in Lower Middle M&A Market and Middle-market Mezzanine!

Learn More

Get a Free Consultation!

- Mezzanine Funding Solutions

- Advisory Services

- End-to-end Acquisition Services

Contact Us!

Business Growth Definition by Authors

Source: https://www.attractcapital.com/business-growth.html

0 Response to "Business Growth Definition by Authors"

Post a Comment